Credit Card Default

Westpac.

THE CLIENT | Deon. H

Deon is an IT professional from Clayton who wanted to purchase an investment property.

Sandringham, VIC

Cleared in: Feb 2018

Duration: 26 Days

The Problem

In 2015, Deon obtained a credit card to pay for work-related expenses, which his employer agreed to reimburse him for. However, Deon was suddenly made redundant and his employer refused to pay the credit card bill, leaving him in debt. This led to a payment default on his credit history from Westpac, and a significant drop in his credit score.

As a result, Deon was unable to get approval for his investment property years later.

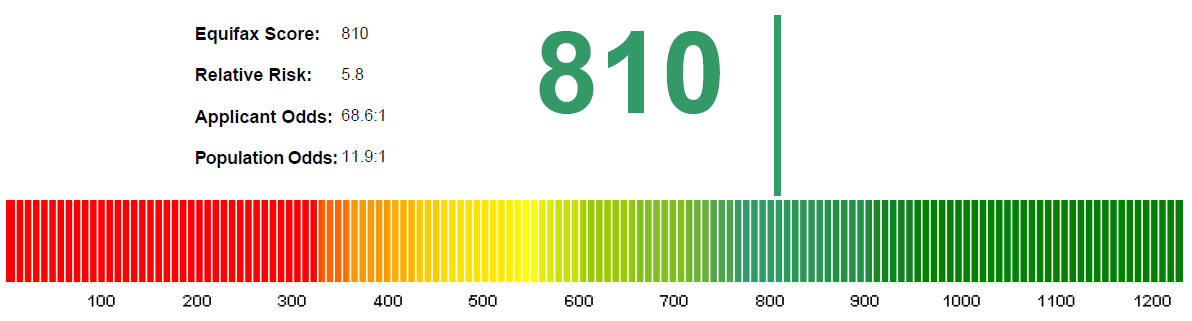

Original Credit Score

New Credit Score

The Solution

We uncovered the exact details of Deon’s dispute with his employer, which Westpac did not consider at the time of the listing. It was found that Westpac did not make sufficient efforts to assist Deon at the time of his extenuating circumstances.

There were also numerous inconsistencies in Westpac’s records, which made it challenging for Westpac to substantiate the validity of the credit default. As a result, Square was able to negotiate for the blackmark to be removed, meaning Deon’s credit score increased and he was able to purchase his investment property.