Default Judgment

Business supplier.

THE CLIENT | Vijay. K

Vijay is a contractor from Roseville who runs a cabinet making service. He wanted to finance a second van to grow his business.

Roseville, NSW

Cleared in: May 2018

Duration: 33 Days

The Problem

12 months earlier, Vijay made a large order of branded calendars with his logo printed on them. He planned to distribute these to market his business. However, the printing supplier did not follow his instructions, resulting in multiple errors with the final product.

This made the final calendars unusable, so Vijay refused to pay for the order. The printing company pursued Vijay through a small claims court, resulting in a default judgement on his credit file. This severely restricted Vijay’s borrowing ability, and so he was unable to get the loan to buy his second van.

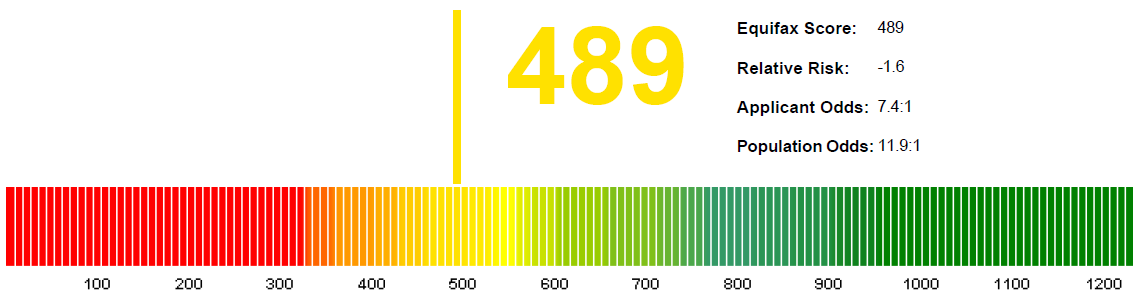

Original Credit Score

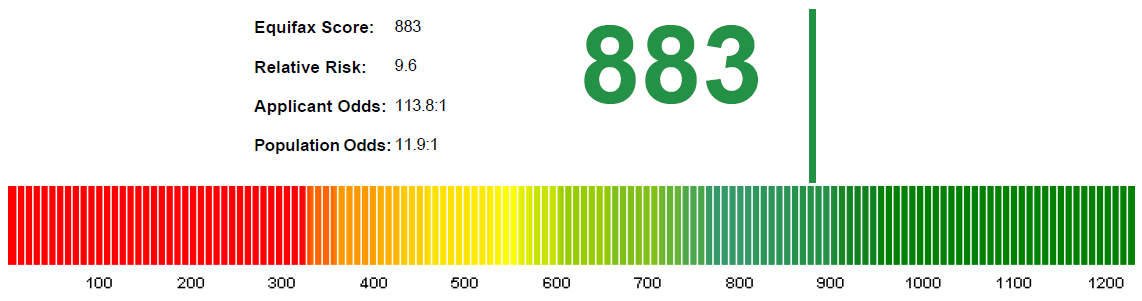

New Credit Score

The Solution

Square entered into negotiations with Vijay’s creditors, and reached a settlement for the outstanding debt, at a significantly discounted rate. Vijay paid the discounted amount, which enabled the default judgement be set aside, and erased from his credit file.

A few months later, Vijay was approved for his loan which he used to purchase a van and expand his operations. Small businesses like Vijay’s are an integral part of the Australian economy, so we were extremely proud to help out.