Business Loan Default

Macquarie Bank.

THE CLIENT | Jamie. R

Jamie is an engineer from Sunnybank who decided to upgrade his mobile phone plan.

Sunnybank, QLD

Cleared in: Mar 2018

Duration: 36 Days

The Problem

Jamie used to run a small business which he funded with a loan. When he decided to close his business, he made arrangements to close his business bank account, and made multiple requests for any outstanding payments to be debited from a different account.

However, Macquarie Bank did not process his requests correctly, and so his loan repayments were not made for some time. This led to a large decline of his credit score.

When Jamie applied for a new mobile phone plan, he was denied due to being a high credit risk, as indicated by his credit file.

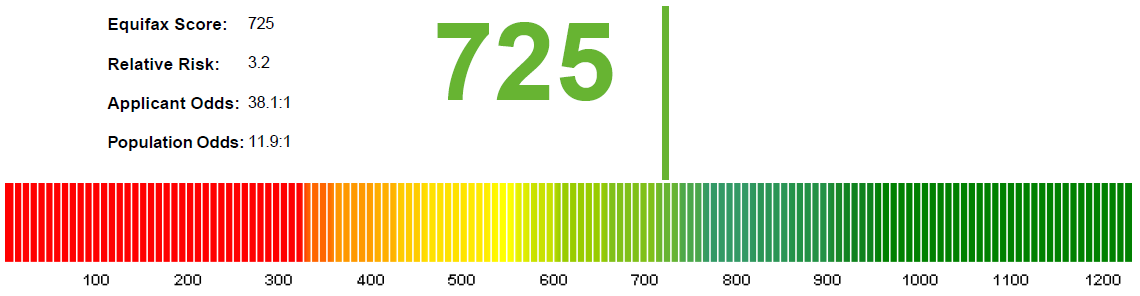

Original Credit Score

New Credit Score

The Solution

We cross-referenced all conversations between Jamie and Macquarie Bank to develop a timeline of events. We found that Jamie did in fact complete the required paperwork to close his account and update his payment details, but Macquarie Bank did not follow through with his requests.

The missed payments were a result of Macquarie Bank’s failure to act, which meant Jamie was not at fault. Due to the unjustifiable nature of the black mark, Macquarie Bank eventually agreed to remove the listing from Jamie’s credit file.

As soon as his credit score was updated, Jamie reapplied for a new mobile phone plan without any problems.